How Clearco (formerly Clearbanc) became the World's Largest E-commerce Investors

The strategies used to build an e-commerce empire and unicorn🦄

Clearco was co-founded in 2015 by Michele Romanow, Andrew D’souza, Charlie Feng, Ivan Gritsiniak, and Tanay Delima. They provide non dilutive capital, resources, and an expansive network to help founders grow and scale their business. They’ve invested $2B+ in 5,500+ businesses.

Strategy 1: Business Model Innovation

They have products tailored for founders in all stages of their journeys, and give investments of $10K to $10M which are repaid via a revenue share agreement plus a 6-12% flat fee. Helping you scale without losing equity in your company.

They started in 2015 as a revenue based funding company for Airbnb hosts and Uber drivers. The concept was if they could help buy extra beds/upgrade your car, it could help you make more money. In exchange they would get paid back in full with a lower default risk.

After many pivots, Clearco still applies the same revenue generating investments and revenue sharing model, but they focus on helping e-commerce founders and online business owners by funding marketing, sales spend, etc in return for a small revenue share and fee.

They realized 40% of VC dollars end up going to Facebook and Google ads and 2.2% of all VC dollars to go women.

Clearco solves both problems by providing less expensive capital and no decision making bias through data modelling.

Strategy 2: 20 minute term sheet (2019)

Instead of forms and negotiations, Clearco uses and promotes a “20 minute term sheet” providing a yes/no within 24 hours if they can get funded.

They built an algorithm to analyze revenue and advertising data to underwrite businesses.

No meetings, pitches are required.

This not only allows them to scale lead gen, but build predictable channels to qualify founders through data and automation with as little time/effort from founders as possible.

Strategy 3: Partnerships

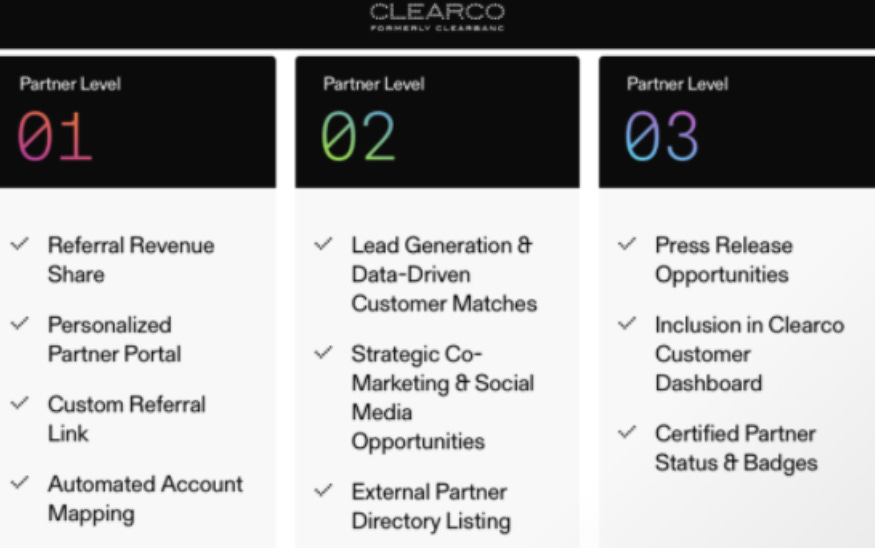

Clearco currently partners with 500+ companies looking to empower entrepreneurs. Partners consist of agencies/services to support Clearco’s founders, with partners receiving a revenue share on any referred companies.

They have 3 levels of partnerships. Each level has more benefits for partners while also providing more value for Clearco’s portfolio founders. Partners can gain revenue share, co-marketing and lead generation, while Clearco gains leads and more resources for founders.

Strategy 4: Outbound Automation

Clearbanc leverages outbound to scale customer and partner acquisitions. Using automated email platforms, they create cold message templates, find leads and send customized messages at scale.

This helps scale customer acquisitions.

Strategy 5: ClearAngel

ClearAngel is Clearco's latest and greatest product. Before ClearAngel, companies needed to do at least $10k in monthly revenue for Clearco to see just enough data to invest.

Before ClearAngel, Clearo funded 4,000 companies but turned down 50,000.

ClearAngel is the solution - built for early-stage e-commerce founders to provide capital, advice, and access to their expansive network. It’s the first ever automated angel investor designed for companies doing at least 2k monthly revenue.

ClearAngel provides a dashboard that includes data driven advice, ai goal setting, while matching founders with the best agencies, apps, consultants, professional services, and investors.

They now help founders grow and scale at the earliest stage, leading to huge growth.

Overall a key aspect of Clearco's growth has been driven by creating various product lines and services for founders in all stages of their business.

The ClearAngel product was launched in March 2021 and have already funded 400+ companies.

Strategy 6: Press

Clearco PR team leverages press to help it grow from a small startup to a unicorn.

Features on TechCrunch, Crunchbase brings in huge traffic/customers and has helped them grow from one stage to the next.

Strategy 7: Growth Experiments

They take an experimental approach to growth, launching several products to acquire new customers. Clearco has launched 6 products on Product Hunt, including Matchme (marketplace matching tool) and Angel’s Club (external community for founders)

Clearco Today:

$2B valuation

Provided $2.4B to 5,500 companies

Expanding internationally

Keys to Growth success:

Model innovation

Partnerships

Product launches

Leverage Press

Growth experiments

After having the privilege to intern on the growth team for the ClearAngel product team at Clearco for the last 5 months, I learned A LOT, grew as a professional, and gained experiences that will leaving a long lasting positive impact on me for my entire career.

Shoutout to Tarik Sehovic, Andrew D’souza, Charlie Feng, and the rest of the ClearAngel team for an amazing experience.

If you enjoyed this thread:

1. Subscribe to my SubStack for a more in depth breakdown of Clearco's rocket growth

https://thegrowthplaybook.substack.com/welcome

2. Follow me @growth_student

for a new growth thread like this every week!

Resources/Citations:

https://techcrunch.com/2021/04/20/clearbanc-unicorn-clearco/

https://www.forbes.com/sites/johnkoetsier/2020/06/27/1-billion-for-2800-startups-how-clearbanc-uses-ai-to-take-bias-out-of-investing/?sh=58c0a91c51d0

https://techcrunch.com/2019/04/03/clearbanc-plans-to-disrupt-venture-capital-with-the-20-min-term-sheet/

https://news.crunchbase.com/news/clearbanc-fills-clearangel-fund-with-100m-to-fuel-companies-that-may-never-get-venture-capital/

https://techdaily.ca/fintech/clearbanc-is-not-a-bank-but-it-will-fund-your-startup